26 April 2017 IFA Finance Roundtable

This summarizes the questions and responses at the IFA Finance Roundtable held on 26 April 2017 in Toronto. The Finance Canada presenters were Ted Cook (Director, Tax Legislation Division, Tax Policy Branch, Department of Finance) and Stephanie Smith (Senior Chief of the Tax Treaties Section, Tax Legislation Division, Tax Policy Branch, Department of Finance). The questions were posed by Ken Buttenham (PwC) and Carolle Fernando (McInnes Cooper). In order to ensure that the panel got through all the questions, Ken generously truncated his later questions.

Q.1 Budget and BEPS Actions

Ken Buttenham: Budget 2017 reconfirmed the Government’s commitment to implement the minimum standards out of the BEPS project. Could you provide us with a general update on Canada’s status with respect to the minimum standards?

Response

Stephanie Smith: I will generally go through what was indicated in the Budget, which provided an update on Canada’s BEPS work.

Starting with the minimum standards, in respect of Action 5 on Harmful Tax Practices, the Canada Revenue Agency has begun spontaneously exchanging rulings and unilateral APAs with other tax administrations. They have also received a number of rulings and unilateral APAs in compliance with the minimum standards.

Respecting Action 16 on Treaty Abuse and Action 14 on Dispute Resolution and making them more effective, the government indicated in the Budget that it was pursuing signature of the MLI. The MLI generally requires acceptance of its minimum standards that are in the MLI. That engages Actions 6, 14 and 5, being in the MLI itself. The Budget also specifically indicated that Canada is committed to the effective and timely resolution of tax-related disputes by improving the mutual agreement procedure in Canada’s tax treaties.

I also note that back in 2015, at the G7 summit, Canada was part of an announcement in which the G7 countries committed to binding mandatory arbitration, at least among themselves, and we will see commitments going even more broadly than that.

Rounding off the minimum standards is Action 13 on Country-by-Country Reporting. Legislation was announced in December 2016 and recently the CRA also issued guidance rspecting compliance with that legislation in particular forms.

The Budget also mentioned sevral other Action Items. Starting with Action 3 on effective CFC rules, it noted that Canada has robust CFC rules, in the form of its FAPI regime. It also noted that with respect to Actions 8 to 10 on transfer-pricing that CRA is applying the revised international guidance on transfer-pricing by multinational enterprises, and the guidelines that are out there generally provide an improved interpretation of the arm’s length principle.

Lastly with respect to Action 12, Mandatory Disclosure Rules, Canada has implemented requirements for taxpayers, as well as promoters and advisers, to disclose specific tax-avoidance transactions to the CRA.

Q.2 Action 1 (Digital Economy)

Ken Buttenham: Action 1, Digital Economy, did not get a lot of press, perhaps because the final report essentially suggested that a lot of the Action 1 issues were dealt with in the other Action Items, such as the CFC Action you mentioned, Action 7 on the artificial avoidance of PEs, and transfer pricing in Actions 8 to 10. Any update on Action 1?

Response

Stephanie Smith: I think that is correct - that Action 1 has, at least in some circles, gotten less attention than any of the other Action Items, because generally it was found that these issues were not specific to the digital economy and would likely be addressed under many of the other Action Items.

That being said, when the report came out in 2015, there was an indication that follow-up work would be done, and it would be carried out by the tax treaty group (Working Party One at the OECD), which would look at the characterization under existing treaty rules of certain digital economy payments occurring under new business models - and especially looking at cloud-computing payments. In this respect, it was agreed by the Committee on Fiscal Affairs that that would form part of the 2017-2018 work program at the OECD which will include not only OECD countries, but what is now referred to as the inclusive framework of the BEPS G20 OECD group. I think you will see some work coming out of that. This is not the first time the OECD has specifically looked at this issue, but it has now been some time. Thus, you will be seeing something coming on Action 1.

Q.3 Action 2 (Hybrid Mismatch Arrangements)

Ken Buttenham: Could you provide an update on Action 2, Hybrid Mismatch Arrangements?

Response

Stephanie Smith: Work has continued since the 2015 report came out. There are some countries that have implemented, or announced that they are implementing this Action Item, in particular, the UK and Australia, and those countries have an interest in facilitating the implementation by many other countries.

There will be a supplementary report coming out later this year dealing with so-called “hybrid branches.” The initial report itself only spoke to hybrid instruments and hybrid entities. One of the other things that the group that works on these issues is doing is examining how to address potential interactions between the BEPS hybrids recommendation and countries' more targeted anti-hybrid rules, for example the Canadian foreign tax credit generator rules.

Q.4 Actions 8 to 10

Ken Buttenham: I don’t know if you had anything else you wish to add on Actions 8 to 10. You touched on the fact that Budget 2017 reiterated the Budget 2016 comments regarding Canada’s applying revised guidance. Is there any update you wanted to provide on OECD G20s work?

Response

Stephanie Smith: There is significant on-going work on Actions 8 to 10, and a number of papers that have been released as discussion drafts. There are expected to be revised discussion drafts, the first one being of the discussion draft on profits splits which was released in 2016. I think it was generally well received and it yielded over 400 pages of comment from the public. You should expect to see a revised draft this summer. There will not be any dramatic changes. However, the revised draft will clarify that the profits split method is not intended as a default method, or a method that is simply to be used just because comparables cannot be found. It will include examples and further clarification on when and how the profit-split method should be applied. In addition, that discussion draft will ask businesses for examples of when profit splits have been used in order to be able to expand the examples that are included in the draft.

Another discussion draft coming out of that work and also the work of the treaty group is on the attribution of profits to PEs. There was a discussion draft that was released last year, and it is expected that there will be a revised discussion draft this summer. The discussion draft that went out last year was actually a non-consensus document, which is an unusual way for a discussion draft to go out. One of the main comments that has been received on the discussion draft was the fact that it spoke only to countries that apply the authorized OECD approach [“AOA”]. Since many countries, even many OECD countries, do not apply the AOA method, there was criticism that the guidance would have limited impact. The guidance in the revised draft will be applicable to both AOA and non-AOA countries.

It will also clarify that double taxation of the same profits should not arise in the source countries as a result of the interplay between the PE attribution process under Article 7 of the treaty, and the transfer-pricing analysis under Article 9 in the case where a PE is created because of the activities of an associated enterprise in the source country. There have been numerous concerns expressed about this issue, and that will be addressed in the revised discussion draft.

There is also upcoming guidance on hard-to-value intangibles. This is very close to being finalized and should be released shortly for public comment.

Rounding out the work in this area is the guidance on financial transactions. This topic is very technical and complex. The working party is working hard and wants to ensure that they can provide good guidance. They have set aside significant time to discuss the issue at their upcoming meeting in June, and there is a desire to keep the momentum going on this work. However, it is difficult to provide a specific date for release of the discussion draft, given the continuing discussions.

Q.5 Action 6 (Treaty Abuse)

Ken Buttenham: Coming out of the session earlier today on inbound and outbound collective investment vehicles, could you provide an update on the application of treaty benefits to non-CIVs?

Response

Stephanie Smith: That relates to the work that was done on Action 6 on treaty abuse. There was a discussion draft (providing three examples) that came out of comments on an earlier discussion draft dealing with examples that could be included in the commentary to the OECD model with respect to the principal purpose test. Work was done at the meeting in February to obtain consensus and get agreement on examples, and the specific drafting of those examples. That will be released as part of the release of the 2017 update to the OECD Model Tax Convention, which I expect will occur in May. As normal, it will be released first for public comment. However, in this case, given the significant amount of work that you will have already seen, there will be some new material and some updated material, including the examples.

You will also see the drafting of the detailed LOB provision, which is expected to be included in the next update to the Model. This arises out of work that continued following the completion of the Action 6 report.

Another issue is the concern raised about obtaining access to treaty-reduced withholding rates and the difficulty in dealing with some tax administrations, and delays in getting refunds in this regard. That isssue has been discussed and acknowledged by countries around the table. They are aware that it is something that cannot be lost sight of if the whole picture for treaty withholding rates is to work - and that it may be time for the OECD to pick up its work on what was termed at the time “TRACE” (Treaty Relief and Compliance Enhancement), which was a system to try to ensure that the relief is received. It is not clear what form that work will take or when it will occur, but it is something that governments are aware of and do not want to lose sight of.

Q.6 Cash Boxes

Carolle Fernando: Budget 2016 made specific reference to cash boxes (capital rich but minimally functional entities) as an aspect of the revised transfer-pricing guidelines that would not be applied by CRA at that time. However, there was no mention of cash boxes in Budget 2017. Could you provide an update?

Response

Stephanie Smith: That is a question that we are asked quite frequently, and I can confirm that there is no intended implication, by the absence of language on this issue in Budget 2017. The work has not yet been completed by the OECD and the BEPS group, and as a result the Department has not yet finalized its position. As for timing on these issues, I think the work on financial transactions will likely feed into this, so it is difficult to provide exact timing but, to again clarify the point, there was no intended implication by the absence of mention in this year’s budget.

Q.7 “Hotel California” MLI adoption

Carolle Fernando: Could you elaborate (further to your comments yesterday [in Q.5]) on the “Hotel California” feature of the MLI: a country can sign on to the MLI, but never leave?

Response

Stephanie Smith: The MLI, which is a unique instrument, provides a number of choices, options and flexibility on the way in, but there is another aspect to the MLI that locks in a country once it has made those decisions. There is a lot of interest, not just with respect to the positions which Canada will take, but also for other countries because, unless there is a match, the MLI will not apply.

On signature (the signing ceremony for which will be on June 7, with many countries participating) all countries are required to deposit provisional reservations and notification. International law does not require depositing reservations or notification on signature - but the MLI specifies that the provisional reservations and notifications must be deposited. This is an attempt to ensure that positions are clear and that any mismatches and confusion can be worked out with treaty partners before ratifieation.

What will be provided at the time of signature is the list of tax agreements countries are willing to cover. There will be reservations and choices with respect to the minimum standard, both on what the treaty-abuse rule is, and in respect of some of the changes to the MAP provision in treaties. There will also be an indication of what provisions beyond the minimum standard that countries are willing to or not willing to pick up. Alos included will be whether countries are choosing to include arbitration.

On ratification, which will occur after all domestic procedures have been completed, countries will have to deposit their final reservations and notifications – so things can change between signature and ratification without any implications. You do not have to look to the MLI for that - that is simply how international law works. Ratification means that there is Parliamentary approval, which is why these items are provisional on signature.

The country is in Hotel California after ratification. Following ratification, a country can add covered tax agreements to the list that they initially submitted, but they cannot withdraw any agreement that they have previously listed. A country can remove reservations – and generally that would mean adding or taking on more provisions from the MLI, but they cannot add reservations. Once one of the optional provisions has been picked up, there is no backtracking on that.

Another interesting aspect of the MLI is that while, as with any other international agreement, the MLI can be terminated, even if this occurs (and as specified in the agreement itself) any change that has been made to a bilateral tax treaty will remain in effect nowithstanding the MLI termination.

A termination would mean that any future matches would not then update the bilateral agreement of that partner because it had terminated the MLI. That might help explain the thinking of countries that are looking at what to sign on to, and when and how.

It is unclear what some countries will wish to do with the PE provisions, and whether some will want to wait and see what some other countries are willing to do. That may influence some countries' choice of initial provisions - because they can add on later, but not retract.

Q.8 2014 domestic Anti-Treaty-Shopping rule

Carolle Fernando: Now that Finance has confirmed that Canada will sign the MLI, can you now confirm that the domestic anti-treaty shopping rule that was proposed in Budget 2014 is now going to be formally abandoned?

Response

Stephanie Smith: The government has committed to pursuing domestic approvals for MLI signature, which must be obtained. Given that the MLI itself requires the minimum standards and the default provided for is the principal purpose test (with provision to reserve out of that, and indicate an intention to bilaterally negotiate a detailed LOB), it would be fair to say that the current position of the government is to pursue a treaty-based anti-treaty shopping provision consistent with the BEPS minimum standard.

Thus, the government is not at this time pursuing the formerly proposed comprehensive domestic anti-treaty-shopping provision.

Q.9 General upstream loan perspective

Carolle Fernando: The upstream loan rules were introduced in 2011 and enacted in 2013, and have seen some significant amendments already. Could you provide us with a brief look at the work that has been done so far on the rules and how the changes are working from the Finance perspective.

Response

Ted Cook: Since the upstream loan rules were first introduced in 2011, there have been a number of changes made, many of them relieving changes in response to stakeholder submissions. The package of draft technical amendments, which was released in September 2016, included a number of changes in respect of the upstream loan rules, particularly:

-

the introduction of continuity rules, that would ensure that the upstream loan rules apply appropriately in the case of corporate reorganizations;

-

significantly expanding the scope of transitional set-off or foreign exchange gains and losses on remittance of grandfathered upstream loans; and

-

the implementation of a comfort letter to ensure that the rules are not engaged in the case of loans made to certain joint venture entities.

What we have attempted in our work on the upstream loan rules is to prioritize the issues that we perceive to be of greatest urgency and ones where we are trying to work with taxpayers where they cannot take reasonable steps to avoid inappropriate adverse impacts.

Q.10 Sale following upstream loan

Carolle Fernando: One example illustrating a technical issue relating to the upstream loan rules deals with the repayment requirement in paragraph 90(8)(a) and subsection 90(14). These are the provisions that generally allow the taxpayer to avoid the income-inclusion from an upstream loan, to the extent that the loan is repaid, otherwise, then as part of a series of loans and repayments within the specifed two-year time frame. It has been suggested that this repayment requirement is perhaps drafted too narrowly, and that it should be expanded to deem certain triggering events to be a repayment where those triggering events would result in the upstream loan no longer being within the intended scope of the rules.

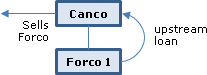

In this example, a foreign affiliate (Forco1) of the Canadian parent (Canco) had made a loan to Canco. Forco1 is subsequently sold, thereby ceasing to be a foreign affiliate of Canco. Under the existing rules, the upstream loan would not be considered to be repaid for the purpose of subsection 90(14). This is an issue that has been raised by the Joint Committee on Taxation, with the recommendation that the repayment requirement be amended with a deeming rule.

Could you provide us with an update on Finance’s consideration of this issue or any work being done relating to the possible broadening of the repayment requirement?

Response

Ted Cook: I would reiterate my earlier point that what we are trying to do is prioritize in relation to where it is harder for taxpayers to take steps to address the particular issue. It seems to us that this example may be a case where the taxpayer is more able to take steps to mitigate the issue.

While repayment may pose certain difficulties and costs, it is not clear to us that this is insurmountable, particularly in cases generally of loans arising between related parties. CRA indicated [in 2013-0491061R3] that a temporary repayment of a loan, in the course of certain transactions in which the creditor foreign affiliate ceases to be an FA of the taxpayer, will be treated as a permanent repayment, and not part of a series of loans and repayments, for the purposes of the upstream loan rules.

That being said, I think that the general policy intent of the upstream loan rules is to ensure that a synthetic distribution by way of an upstream loan from a foreign affiliate should produce comparable tax results to an actual distribution, and that the repayment rule in s. 90(14) supports the policy that the rules apply only for so long as the synthetic distribution persists. We recognize that there are certain transactions where the loan is not repaid, but functionally result in there no longer being a synthetic distribution. As a result, we are continuing to consider whether triggering events should be included in the rules and, if they should be, what exactly those triggering events should be.

Our preference is to be able to do a considered, full analysis in this kind of situation rather than responding incrementally. If you accept that there should be a triggering events rule, then an obvious case would be where there is a taxable sale at fair market value for cash consideration, and that would be pretty clear. But then, considering, for example, the situation raised yesterday involving debt-forgiveness amounts that might arise in different circumstances, it seems to us that, once you start digging below the surface of the “poster child” of what would be a triggering event, there will be permutations and combinations to be considered before coming up with a cohesive set of rules.

Q.11 Upstream loans where blocking deficit

Ken Buttenham: Another common concern has been raised respecting the upstream loan rules. It has to do with what has often been referred to as the “reserve mechanism” in ss. 90(9), (11) and (12). It arises especially where there is a blocking deficit in the top FA tier. These provisions are meant to ensure that only the portion of the upstream loan that creates a Canadian tax benefit is really caught by these rules.

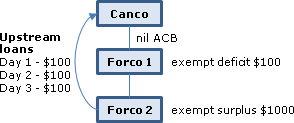

In this example, to the extent that Forco 2 could distribute an amount equal to the upstream loan amount up to Canco tax-free, then clearly there is really no tax benefit of lending directly, and a reserve is supposed to operate accordingly. However, it does not operate very well where there is a blocking deficit in Forco 1. [The text of the prepared slide states: Each upstream loan must be analyzed as a separate notional distribution at the time that Forco 2 advanced the loan. It does not appear to be possible, when applying paragraph 90(9)(a) to a new upstream loan amount, to assume the movement of surplus on prior notional distributions. In this example, Forco 1 will continue to have a $100 deficit for the purposes of each notional distribution made by Forco 2. As a result, Canco will not be able to claim a subsection 90(9) deduction in respect of any of the upstream loans despite having sufficient net surplus in the group. For further discussion, see Kandev/Slaats.] Is there ongoing work in this area? (CRA has, in some administrative positions, provided some tools to help mitigate some of this.)

Response

Ted Cook: I think that is right. I will just reiterate CRA’s response at the 2016 Roundtable [Q.5] on the potential application or not, in this sort of situation, of the back-to-back loan rules in s. 90(7). The CRA’s position with respect to their potential application has been to give some comfort to taxpayers in a sort of a work-around on this particular issue.

It is not clear to us at Finance how much of a live issue this is for taxpayers. If it is a live issue for taxpayers, we are interested in hearing from them. The general policy is that they should be permitted to receive the loans without a deemed dividend, if an actual distribution would give the same result.

Q.12 S. 212(3.6) B2B application to common-share dividend

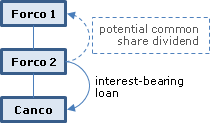

Carolle Fernando: The first question on the back-to-back rules deals with the character substitution rules, which are aimed at preventing taxpayers from avoiding the back-to-back rules by substituting funding arrangements with economically similar arrangements. Generally these rules can apply where there is an intermediary with an obligation to pay a dividend on shares, or to make a rent or royalty payment, and one of the connecting tests is met with respect to the particular funding arrangement.

In the example, an intermediary (Forco 2) makes an interest bearing loan to Canco, and Forco 1 holds (ordinary) common shares in Forco 2.

The tax community has raised concerns about the breadth of paragraph 212(3.6)(a). The pertinent wording is:

… at any time at or after the time … an obligation to pay or credit an amount as … a dividend on the shares, either immediately or in the future and either absolutely or contingently … .

It basically provides that the character substitution rules would apply in respect of shares of the capital stock of the particular relevant funder, Forco 2 in this example. Suppose that, among other conditions being met, the condition on the slide is met (that, at any time at or after the time when the particular debt was entered into, the relevant funder has an obligation to pay or credit an amount as a dividend, either immediately or in the future). The concern is the potential application of this provision to common shares that do not have a share-term requiring the payment of a dividend, given the fact that a relevant funder is always going to have an obligation to pay a dividend once it is declared.

Essentially, the breadth of the rule along with the breadth of the temporal requirement is where the concern is coming from. Our question is, can Finance expand on the intent of the condition in s. 212(3.6)(a) and on whether common shares, with no obligation in the share terms to declare any dividends, were intended to be excluded from the character substitution rules?

Response

Stephanie Smith: The intention of this provision, and more generally of the character substitution rules, is to prevent abuse through a rather obvious device to circumvent the new back-to-back rules by structuring arrangements by using instruments and payments of different legal characters. This is especially possible where there are internal group structures and there is the flexibility to use both preferred shares and common shares. The intention was to capture dividends paid on preferred shares with a fixed dividend entitlement, but also dividends paid on common shares, on the basis that a dividend declaration respecting common shares also gives rise to an obligation to pay a dividend on the common share.

Of course, whether the rules are actually going to apply would depend on whether the linkage test would be met, and that would require consideration of all of the relevant facts and circumstances to determine whether there is sufficient linkage. Presumably, two of those relevant factors would be timing and the quantum of the dividend payment.

Q.13 S. 15(2.17) B2B double-counting re cash pool

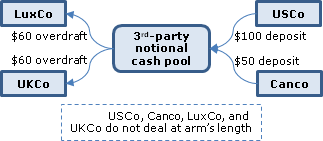

Ken Buttenham: This question has to do with an anomaly in the B2B rules respecting the potential double-counting of the provision of a double deemed shareholder loan in the situation where there are multiple parties contributing to a single notional cash pool and multiple targets drawing from the notional cash pool. Assuming the connection conditions are met, would you apply s. 15(2.17)? I think you will find that each of Luxco and UKCo, as the intended borrowers, would be considered to have received a loan from Canco of $50, which gives the result there is a deemed shareholder loan of $100, yet Canco only put $50 into the pool. Comments?

Response

Stephanie Smith: The Department can confirm that, in the circumstances depicted in this example, the intention of the back-to-back shareholder loan rules is to limit the aggregate amount of loans that Canco is deemed to make under those rules, to the amount that Canco has loaned to the immediate funder. This is consistent with the general policy of the rules, which is to ensure that the shareholder loan rules are not avoided to the extent that a Canadian corporation provides debt-funding to its shareholders indirectly through one or more intermediaries.