WesternOne

Units exchanges

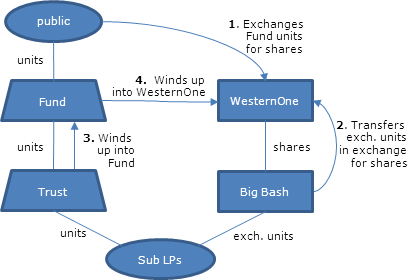

Proposed Plan of Arrangement under the CBCA under which all the outstanding units of the (TSX-listed) Fund are exchanged on a one-for-one basis for common shares of a recently-incorporated CBCA corporation (WesternOne Inc.) (with the one initial share of WesternOne Inc. heretofore held by the Fund cancelled.)

Exchangeable units held by "Big Bash Inc." in an indirect subsidiary LP of the Fund (and a direct subsidiary LP of the subsidiary "Trust" of the Fund) are also exchanged on a one-for-one basis for common shares of WesternOne Inc. An s. 85(1) election will be filed respecting this exchange.

Fund/Trust windings-up

The Fund surrenders for cancellation all the Trust units, so that the Trust is wound up; and WesternOne Inc. surrenders for cancellation all the Fund units, so that the Fund is wound up.

Rights Plan

Although the resolutions for approval include the adoption of a unitholders' rights plan for the Fund, all the issued and outstanding rights are cancelled before the unit exchange - and then as one of the final steps in the Plan of Arrangement the rights plan is deemed to have been amended and restated to reflect the Arrangement such that from and after the termination and dissolution of the Fund, the rights plan automatically applies to the WesternOne Inc. Inc. shares and shareholders.

Canadian income taxation

Provided the Plan of Arrangement becomes effective by December 31, 2012, the Fund unitholders will be deemed under s. 85.1(8) to have disposed of their units for their cost amount. As units of the Fund typically will not be taxable Canadian property, s. 85.1(8)(b) typically will not apply to deem the shares of WesternOne Inc. to be taxable Canadian property.