Dundee/DREAM

Overview

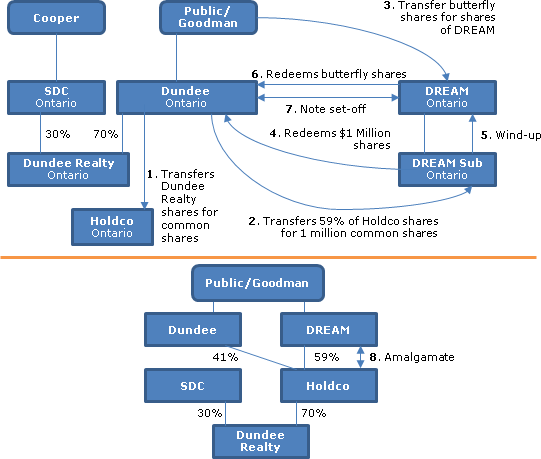

Dundee, which has a 70% interest in Dundee Realty, and is controlled by Ned Goodman due to a multiple voting share structure, will spin-off an approximate 50% interest in Dundee Realty to its shareholders through a butterfly reorganization, so that such shareholders will hold comparable common and subordinate voting shares of a new Ontario public company, DREAM - and so that DREAM also will be controlled by Ned Goodman. Dundee will retain an approximate 20% indirect interest in Dundee Realty by virtue of holding approximately 28.57% of the total subordinate voting and common shares of DREAM. Following the spin-off, Dundee will continue to engage in diverse business activities including asset management, capital markets and personal advisory services and private equity investments. Based on the anticipated relative liquidation amount of the preferred shares to be held in reorganized Dundee ($18.67 per share) and in DREAM ($6.33), approximately 25% of the shareholders' equity will become equity of DREAM.

Existing structure

The issued share capital of Dundee, an Ontario corporation, consists of 74.4M subordinate voting shares (3.34% owned or directed by Ned Goodman, and the balance by the public), 3.1M common shares (99% owned or directed by Ned Goodman) which carry 100 votes per share and are convertible on a one-for-one basis into subordinate voting shares, and 6M Series 1 preference shares with a liquidation amount of $25 per share. Dundee owns 70% of the common and Class C preferred shares, and 100% of the Class D preferred shares, of Dundee Realty, an Ontario corporation, with 30% being owned by Sweet Dream Corp. ("SDC"), an Ontario corporation controlled by Michael Cooper, the CEO. In addition to its real estate assets, Dundee Realty is the asset manager of Dundee REIT, Dundee International REIT and Dundee Industrial REIT.

Pre-Arrangement steps

On April 9, 2013, each of DREAM, DREAM Sub and Holdco were formed under the OBCA. DREAM did not have any issued share capital; Holdco issued one common share to Dundee; and DREAM Sub issued one common share to DREAM.

Plan of Arrangement

Under the Plan of Arrangement:

- the terms of the stock options to acquire Dundee subordinate voting shares will be adjusted so that there is a right on exercise to also be paid a fraction of a DREAM subordinate voting share

- Dundee will transfer its common shares of Dundee Realty to Holdco in consideration for Holdco common shares (s. 85(1) election)

- REIT Amalco (a subsidiary of Dundee holding Dundee Realty Class C shares) will transfer such shares to Holdco in consideration for Holdco common shares (s. 85(1) joint election)

- Dundee dissenting shareholders will be deemed to have transferred their shares to Dundee

- each Dundee common share, subordinate voting share and Series 1 Preference Share will be exchanged for two shares – one of them a "butterfly" share, and the other corresponding in various attributes to the "old" share; TSX listings become effective

- holders of Dundee DSUs will receive "top-up" DSUs

- each Dundee butterfly share will be transferred by the holder to DREAM in exchange for a DREAM common, subordinate voting or special share (confusingly, also called a butterfly share), as the case may be

- Dundee will transfer to DREAM Sub such number of Holdco common shares as will result in it having, at the completion of the Arrangement, an aggregate 28.57% interest in the DREAM subordinate voting and common shares in consideration for 1,000,000 common shares of DREAM Sub (s. 85(1) joint election)

- DREAM Sub will purchase the 1,000,000 common shares for cancellation in consideration for the DREAM Sub Note, and will be deemed to have designated the resulting deemed dividend to be an eligible dividend

- DREAM Sub will be wound up into DREAM

- Dundee will redeem the Dundee butterfly shares in consideration for the issuance of a demand note (the Dundee Note)

- Dundee will repay the Dundee Note by delivering the DREAM Sub Note; and DREAM will repay the DREAM Sub Note by delivering the Dundee Note

- DREAM and Holdco will be amalgamated, so that the Holdco common shares held by DREAM will be cancelled, the Holdco common shares held by Dundee and REIT Amalco will be converted into DREAM subordinate voting shares (to be listed), the issued and outstanding DREAM subordinate voting and common shares will survive, and each holders of a DREAM butterfly share will receive a DREAM preference share (to be listed)

- the Exchange and Permitted Sales Agreements will become effective

Permitted Sales Agreement

Upon the earlier of a specified triggering event (e.g., the termination of Michael Cooper without cause, incumbent diretors of (amalgamted) DREAM ceasing to constitute a majority or persons other than Goodman/Cooper acquiring control of DREAM), SDC may require DREAM to either (i) purchase all of SDC's shares of Dundee Realty or (ii) cause the sale of all of those shares, or the liquidation of Dundee Realty (the choice among these option's being Dundee Realty‘s). DREAM will have a somewhat similar put right.

Exchange Agreement

(Amalgamated) DREAM, SDC and Dundee Realty will enter into the Exchange Agreement, which will provide SDC with the right to exchange its shares of Dundee Realty for subordinate voting shares of DREAM on a tax-deferred basis under s. 85(1).

Canadian tax consequences

Dundee share exchange. The s. 86 rollover will apply on the exchange of each Dundee share for two shares (one of them, a butterfly share).

Dundee butterfly share transfer

S. 85.1 will govern the transfers of Dundee butterfly shares to DREAM (so that rollover treatment will apply unless a gain or loss is reported on the transfer) unless a joint election under s. 85 is made. Three signed copies of the election must be provided to DREAM within 60 days of the effective date of the Arrangement.

Amalgamation

Rollover.

Butterfly

Completion of the Arrangement is conditional on Dundee and DREAM receiving a Canadian tax opinion from Wilson & Partners LLP that the Arrangement should qualify for butterfly treatment. However, the opinion will note that Dundee and/or DREAM will recognize a taxable gain if (i) within three years of the Effective Date, DREAM engages in a subsequent spin-off or split-up transaction under s. 55, (ii) a "specified shareholder" disposes of new Dundee shares or DREAM shares (or property that derives 10% or more of its value from such shares or property substituted therfor) to an unrelated person or partnership as part of the series of transactions which includes the Arrangement, or (iii) there is an acquisition of control of Dundee or DREAM that is part of the series of transactions that includes the Arrangement. If such an event were due to an act of Dundee or DREAM, Dundee or DREAM, as applicable, would generally be required to indemnify the other party under the Arrangement Agreement.

Goodman RRIF

Under existing law (but not under potential amendments referred to in a Finance comfort letter), the new Dundee and DREAM shares to be acquired under the Arrangement by a RRIF of Ned Goodman would be prohibited investments, so that there acquisition may be subject to a 50% tax under Part XI.01. Dundee has agreed to indemnify him in the event that he is assessed for this tax.

U.S. tax consequences

Distribution. A U.S. holder who receives DREAM shares under the Arrangement should be considered to have received a taxable distribution, so that if Dundee is not treated as a PFIC, such U.S. holder generally will be required to include the fair market value of DREAM shares in income to the extent of Dundee's current or accumulated earnings and profits. Discussion of PFIC alternative.

PFIC status

"Based on their projected income, assets and activities, the Company [i.e., Dundee] currently believes that there is a meaningful possibility that the Company and/or DREAM could be treated as PFICs for the current taxable year and taxable years thereafter."