First Quantum/Lumina

Overview

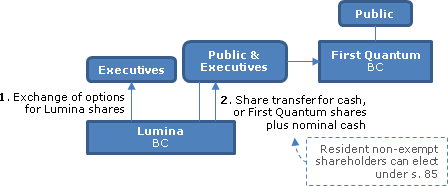

All the shares of Lumina are to be acquired under a BC plan of arrangement by First Quantum in consideration (subject to dissenter share adjustments) for 9.67M First Quantum shares and $222M cash (with the overall consideration of $440M representing a 28% premium). Lumina shareholders are given a choice of $10.00 per share cash (the "Cash Consideration"), 0.4348 of a First Quantum share plus $0.01 of cash (the "Share Consideration") or $5.00 in cash and 0.2174 of a First Quantum share (the "Cash and Share Consideration"), subject to the overall cash/share proportion being fixed. Taxable Canadian resident shareholders may elect under s. 85. Options are surrendered under the Plan of Arrangement on a cashless basis.

Lumina

Is a TSXV-listed B.C. company with 44M outstanding common shares, owned as to approximately 25.1% by Ross Beaty (also an employee) and his personal holding company, and 2.95M outstanding options. It indirectly holds a copper developmeent project in Argentina. First Quantum puchased 2.5M shares in October 2012.

First Quantum

Is a B.C. company and an international mining company listed on the TSX and trading on the LSE with 591M outstanding common shares and market cap of $13.9B.

U.S. Securities law

The First Quantum shares will be issued in reliance on the s. 3(a)(10) exemption.

Break fee

$16.3M in some circumstances.

Plan of Arrangement

- Lumina shares of dissenters will be transferred to First Quantum, with an entitlement to be paid their fair value

- Each optionholder shall transfer to Lumina each Lumina Option held and in consideration for such transfer (and not pursuant to the Stock Option Plan), Lumina shall issue a fraction of a Lumina Share whose numerator equals the difference between 10.00 and the exercise price for such option and whose denominator is 10.00

- Each outstanding Lumina share will be transferred to First Quantum for the Cash Consideration, the Share Consideration or the Cash and Share Consideration, as elected but subject to pro-ration

Canadian tax consequences

In the absence of an s. 85 election, the exchange will occur on a non-rollover basis. The deadline for providing an. s. 85(1) or (2) election form to First Quantum is 90 days after the Effective Date of the Plan of Arrangement – with First Quantum to return within 90 days. "Eligible Holders" (not defined) for purposes of being permitted to make the election appear to be non-exempt Canadian residents and partnerships with any such member. Capital gains/loss treatment will apply to dissenters except re interest. Non-residents who do not hold their shares as taxable Canadian property will not be subject to tax on disposing of their shares.

U.S. tax consequences

Exchange. Depending on whether and how First Quantum integrates Lumina , the IRS could assert that the Arrangement constituted a reorganization for Code purposes. Subject to this point and subject to the PFIC point below, on the exchange of a Lumina share for First Quantum shares and/or cash, the U.S. Holder will recognize capital gain or loss in an amount equal to the difference between the U.S. Holder's adjusted basis in the share and the fair market value of such consideration.

PFIC rules

Lumina believes that it is currently a FPIC and has been a PFIC since 2008. First Quantum is believed not to be a PIC. On this basis and subject to the exceptions below, the amount of U.S. federal income tax on gain recognized by a U.S. Holder upon the consummation of the exchange pursuant to the Arrangement will be increased by an interest charge to compensate for tax deferral, and the amount of income tax, before the imposition of the interest charge, will be calculated as if such gain was earned ratably over the period the U.S. Holder held its Lumina Shares and was subject to U.S. federal income tax at the highest rate applicable to ordinary income for the relevant taxable years, regardless of the tax rate otherwise applicable to the U.S. Holder. However, if the U.S. Holder has made a timely and proper qualified electing fund ("QEF") election or a timely "mark-to-market" election, then the PFIC rules described above will not apply.