Starlight No. 3

Overview

The Fund will invest in three apartment buildings, with a purchase price of U.S.$92 million, in Texas, through wholly-owned LLCs of Starlight U.S. Multi-Family Core REIT Inc. (the "U.S. REIT"), an indirectly owned Maryland corporation; and intends to make further acquisitions of apartment buildings in the southern US. It is issuing up to 6.0M units (allocated among different classes) for up to US$60M. The U.S. REIT is intended to be a REIT for Code purposes, and its income is targeted not to give rise to foreign accrual property income for Canadian purposes in reliance on the over-five full-time employee/rental business exclusion. 3.5% of the targeted returns of 12% per annum are from anticipated capital appreciation to be realized from the sale of the portfolio within three years, with the balance to come from 65% leveraging of apartments purchased at a cap rate of 6% using mortgage financing at 2.5%.

This is similar to the Fund No. 1 (summarized below) and No. 2 offerings.

The Fund

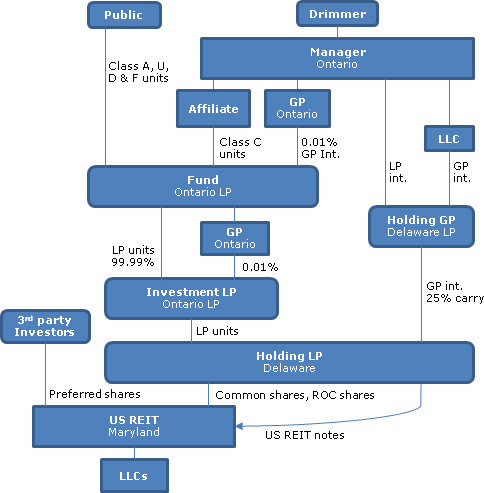

The general partner of the Fund (an Ontario LP) will be an Ontario corporation owned by Starlight Investments Ltd. (the "Manager"), an Ontario corporation, which is controlled and indirectly owned by Daniel Drimmer. The term of the Fund will be three years subject to two one-year extensions at the discretion of the general partner. Deployment of unallocated subscription proceeds is targeted within nine months.

Structure

An Ontario LP ("Investment LP") owned directly and through the GP thereof, will hold all of the LP units of a Delaware holding partnership ("Holding LP") which, in turn, will hold 100% of the common shares of the U.S. REIT and may also acquire U.S. REIT Notes. The GP of Holding LP will be a Delaware partnership directly and indirectly owned by the Manager. In order that the U.S. REIT will qualify as a REIT for Code purposes, the U.S. REIT will issue up to 125 preferred shares at U.S.$1,000 per share to accredited investors. The preferred shares are non-voting, have a redemption and liquidation amount of $1,000 per share and have a dividend yield of 12.5%. Holding LP also will be issued ROC shares (bearing a compounding dividend and redeemable for the subscription amount) by the U.S. REIT, which may also issue interest-bearing REIT Notes. The U.S. REIT's Charter provides that, subject to certain exceptions, no person may beneficially or constructively own more than 9.8% in value or in number of shares, whichever is more restrictive, of the outstanding shares of any class or series of the U.S. REIT's capital stock.

Fund Units

The Class A and U units of the Fund will be listed and will pay distributions in Canadian and US dollars, respectively. The Class D Units and Class F Units are denominated in Canadian dollars and designed for institutional investors and fee based accounts, respectively, wishing to make their investments and to receive distributions in Canadian dollars and differ from the Class A Units and Class U Units in being subject to lower fees, being unlisted and being convertible into Class A Units. The Class C Units are denominated in Canadian dollars and are designed for an affiliate of the Manager, certain other investors known to the Manager and "Lead Investors," if any, and differ from the Class A Units in not being required to pay fee, being unlisted, being convertible into Class A Units, may not be sold or converted for four months after the Closing Date and will represent a 9.99% voting interest in the Fund.

Debt

After giving effect to the further proposed property acquisitions (of approximately U.S.$64M), the overall mortgage to value ratio will be approximately 60% to 70% of the property acquisitions costs (as increased by any property improvement reserves).

Distributions

"The Fund will target an annual pre-tax distribution yield of at least 7% across all Unit classes and aim to realize a minimum 12% pre-tax, investor internal rate of return across all Unit classes upon disposition of the Properties at or before the end of the targeted three year investment horizon." Investment LP, as the holder of the LP units of Holding LP, will be entitled to receive a 7% preferred return on those units, and 75% of the excess, with the balance of 25% going to the GP of Holding LP as a carried interest. No FX hedging of the income of the Fund will occur.

Canadian tax consequences

SIFT tax. The Fund (as well as Investment LP) is not expected to hold any non-portfolio property, so that no SIFT tax is anticipated. As it will not hold any taxable Canadian property, it is not subject to non-resident ownership restrictions.

Consent dividends

Any consent dividend deemed to be received by the Fund from the U.S. REIT as a result of an election under Code s. 565 would not be income to the Fund. However, the Fund would include in its income as a shareholder benefit any U.S. tax remitted by the U.S. REIT with respect to consent dividend elections, and the amount of any such U.S. tax attributable to a particular Fund unitholder would be treated as non-business income tax from a U.S. source for foreign tax credit purposes.

FAPI

The Fund expects that any CFA will satisfy the more-than-five full-time employee test directly or under s. 95(2)(a)(i).

Income allocations

Taxable income of the Fund will be allocated to unitholders based on relative distributions.

FTCs

Any U.S. withholding tax on distributions by Holding LP to Investment LP generally will be eligible for foreign tax credits as non-business income taxes, subject to various limitations. The FTC generator proposals are not expected to apply.

Unit conversions

"Holders of Convertible Units should consult their own tax advisors regarding the consequences of converting their Convertible Units into Class A Units, including whether or not such a conversion will constitute a taxable disposition."

U.S. tax consequences

Investment LP/FIRPTA. Investment LP (but not Holding LP) will elect to be treated as a corporation. Distributions made by the U.S. REIT that are attributable to the sale or exchange of U.S. real property interests by the U.S. REIT, and distributions made by it in excess of both its earnings and profits and Holding LP's adjusted basis in U.S. REIT shares may be subject to Code s. 1445 withholding. The IRS may grant permission to reduce such withholding where it is in excess of the FIRPTA tax applicable to such capital gains dividends or other distributions received from the U.S. REIT. Holding LP will be required to withhold Code s. 1446 withholding at 35% on Investment LP's allocable share of gain from either Holding LP's disposition of U.S. REIT common stock and U.S. REIT ROC shares, or from the U.S. REIT's capital gains dividends and/or distributions made by the U.S. REIT in excess of both its earnings and profits and Holding LP's adjusted basis in U.S. REIT shares. However, Regulations provide that where a partnership is subject to both s. 1445 and 1446 withholding, it will only be subject to the payment and reporting requirements of s. 1446 with respect to partnership gain from the disposition of US real property interests. Investment LP may also be subject to branch tax - but potentially only at a reduced Treaty rate based on the Treaty residence of the Fund unitholders.

Unitholder tax

Non-U.S. unitholders generally will not be subject to tax upon a disposition of their Fund units.

U.S. REIT FDAP Distributions

Interest and dividends paid to Holding LP will be treated as paid directly to Canadian-resident unitholders of the Fund (through Investment LP and the Fund) because each of Holding LP, Investment LP and the Fund will be treated as fiscally transparent entities in their respective jurisdictions - so that such unitholders who are eligible for benefits under the Canada-U.S. Treaty likely will be treated as the beneficial owners of such "FDAP" income (i.e., for purposes of Article IV, para. 6). Accordingly, ordinary REIT dividends treated as being paid by the U.S. REIT will be subject to U.S. withholding at a rate (subject to documentary requirements) of: - generally 0% for RRSPs; 15% for individuals owning less than 10% of the stock of the U.S. REIT including TFSAs or RESPs with individual beneficiaries; and 30% for corporations provided that the U.S. REIT is not "diversified." Interest on the U.S. REIT Notes will be eligible for 0% withholding if the Fund unitholder is eligible for Treaty benefits and provides appropriate withholding tax documentation.

Interest deduction

Holding LP and the U.S. REIT intend to treat the U.S. REIT Notes as debt, so that the U.S. REIT will claim interest deductions. Discussion of s. 163(j) earnings strippings rule.

Interest withholding

"[A] payment of interest income on the U.S. REIT Notes by U.S. REIT to Holding LP will be treated as being paid directly to the Non-U.S. Unitholders because each of Holding LP, Investment LP and the Fund are treated as fiscally transparent under the laws of their respective jurisdictions of formation (and notwithstanding that Investment LP has elected to be treated as a corporation for U.S. federal income tax purposes) and, as a result, such Non-U.S. Unitholders are likely to be treated as the beneficial owners of the U.S. Notes interest income (which is U.S. source FDAP income) for purposes of the Treaty (provided that they are not themselves treated as fiscally transparent under the laws of their respective jurisdictions of formation). A Non-U.S. Unitholder that is the beneficial owner of the U.S.REIT Notes interest income should be eligible for the 0% U.S. withholding tax rate on interest income provided that such beneficial owner is eligible for benefits under the Treaty and provides the appropriate withholding tax documentation to the withholding agent."

FATCA discussion.

REIT status

The U.S. REIT intends to make and maintain an election as a real estate investment trust under the Code in its first taxation year, and management anticipates that the U.S. REIT will qualify as a REIT under the Code.

RRSPs/TFSAs

"This summary assumes RRSPs, RESPs and TFSAs are treated as either grantor trusts, or as investments of the individual annuitants or holders which are not separate entities from the individuals for U.S. federal income tax purposes."