Delavaco/Sereno

Overview

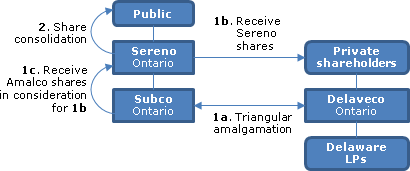

There will be a triangular amalgamation of Delavaco (a privately-held Ontario corporation holding US single-family homes, and which will be acquiring US multi-family properties, through Delaware limited partnerships) with a subsidiary of Sereno ("Subco") so that Delavaco shareholders receive approximately 99% of the shares of Sereno (whose name will be changed to Delavaco Residential Properties Inc. – referred to as the "Resulting Issuer.") Sereno is TSXV listed and was a CPC (capital pool company) issuer which migrated to the NEX due to failure to complete a Qualifying Transaction on a timely basis. The proposed transactions will satisfy the requirement for Sereno to engage in a qualifying transaction under the CPC programme of the TSXV (see TSX-V Policy 2.4 - Capital Pool Companies), thereby permitting it to graduate from a capital pool company to a Tier 2 Real Estate or Investment Issuer.

Background

Delavaco was incorporated on January 27, 2011, and financed its US acquisitions through various private placements of equity and debt. Its homes are mostly rented to working class families in the southeastern U.S., and it already has disposed of a number of homes. It will now be focusing on acquiring multi-family properties. On May 24, 2013, Sereno and Delavaco entered into a letter of intent which contemplated the acquisition by Sereno of all the issued and outstanding Delavaco shares pursuant to a court-approved plan of arrangement, and Sereno's subsequent conversion into a REIT. An agreement for the revised business combination was entered into on September 18, 2013.

Reverse takeover/triangular amalgamation

Subco and Delavaco will amalgamate under the OBCA. On the effective date of the amalgamation:

- The Delavaco shares will be cancelled and their holders (other than dissenting shareholders) will receive common shares of Sereno in accordance with the Exchange Ratio of 7.36.

- The common shares of Subco will be cancelled and replaced with one common share of the amalgamated corporation ("Amalco" – named "Delavaco Properties Inc.").

- The terms of Delavaco warrants will be adjusted, also based on the Exchange Ratio.

- As consideration for the issuance of common shares by Sereno in 1, Amalco will issue to Sereno one common share of Amalco for each such Sereno share.

- Sereno will consolidate all of the outstanding Sereno common shares on a 7.36 to one basis (with comparable consolidations of the Delavaco warrants and options).

These transactions will pursuant to the terms of notes of Delevaco cause the conversion of those notes into common shares of the Resulting Issuer.

As a result, former shareholders of Sereno will hold approximately 1% of the common shares of the Resulting Issuer and the former shareholders of Delavaco holding approximately 99%.

Finco Financing

Concurrently with the completion of the above business combination, a special purpose entity ("Sereno Finco") will complete an offering to raise between $43,700 and $250,000 through issuing non-voting non-participating special shares of Sereno Finco. Under a share exchange agreement to be entered into by these subscribers, the holder of the sole common share of Sereno Finco, and Sereno,these special shares will be exchanged with Sereno (who also wll acquire such common share) for post-consolidation (see 5) common shares of the Resulting Issuer (representing under 0.01% of the total). The purpose of this transaction is to meet the minimum public board lot requirements for a Tier 2 Real Estate or Investment Issuer.

Canadian tax disclosure

A Delavaco shareholder holding Delavaco shares as capital property will receive rollover treatment under s. 87. Under the CRA administrative practices, a dissenting shareholder should be considered to have disposed of its Delavaco shares for proceeds of disposition equal to the amount paid by Amalco (excluding any interest). i.e., no deemed dividend treatment.