Petrominerales -- summary under Share Dividend Programs

Basic program

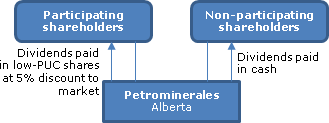

Shareholders will continue to receive cash dividends unless they elect to receive share dividends. Those who elect to participate in the share dividend program will have their dividend satisfied by the issuance of that number of common shares determined by dividing the dollar amount of the dividend on their shares by 95% of the 5-day VWAP value of the common shares immediately prior to the dividend payment date (as described in the amended articles). The shareholder can elect to participate for only a portion of its shareholding.

Fractional shares

Fractional common shares amounting to less than one whole share which are issued to a participating shareholder will be credited to an account for each such shareholder. When the fractional interests increase so as to equal or exceed one whole share, Computershare will cause an additional whole common share to be registered in the name of the participating shareholder. A shareholder who ceases to be a registered holder will be entitled to receive payment in cash equal to the value of the fractional common share held by Computershare for its account. "The crediting of fractional Common Shares (or payment of cash in lieu of fractional Common Shares) to beneficial owners who receive share dividends on common shares held through a broker, investment dealer, financial institution or other nominee will depend on the policies of that broker, investment dealer, financial institution or other nominee."

Stated capital

The Corporation currently intends that a nominal amount will be added to the stated capital account in respect of the share dividends declared (and is permitted under the Business Corporations Act (Alberta) to do so).

U.S. Securities Laws

The Corporation will permit U.S. residents to participate in the share dividend program provided that the shareholder is not a resident of California or any other state where the issuance of securities under the share dividend program would not qualify for a self-executing exemption from registration.

Canadian tax consequences

The amount to be included in a resident holder's income (as well as the amount subject to part XIII tax in the case of a non-resident participating shareholder) will be the amount by which the stated capital of the shares increases. Such (nominal) amount also will be the cost of the share dividend shares to the holder, so that basis averaging will occur.

U.S. tax consequences

Provided that (as anticipated) the Corporation is not a PFIC, a U.S. participant generally will be treated as receiving a distribution equal to the fair market value of the common shares received, plus the amount of any withholding tax withheld and any cash paid. Accordingly, the distribution will be includible in income to the extent such distribution is paid out of current or accumulated earnings and profits.