First Majestic/Orko -- summary under Shares for Shares and Nominal Cash

Overview

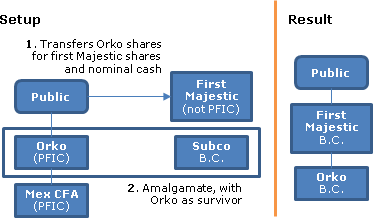

All the shares of Orko, which is a B.C. company listed on the TSX-V and holding a Mexican subsidiary, are to be acquired under a B.C. plan of arrangement by First Majestic, which is a B.C. company listed on the TSX and NYSE, in consideration for First Majestic shares (with a value representing a 72% premium) and nominal cash. Orko then is being merged under the plan of arrangement with a wholly-owned B.C. subsidiary of First Majestic ("Subco").

U.S. Securities law

Each of First Majestic and Orko is a foreign private issuer. Reliance will be placed on the s. 3(a)(10) exemption.

Break fee

$11.5M (expense reimbursement fee of $1.5M).

Plan of Arrangement

Under the Plan of Arrangement:

• The Orko shareholder rights plan will be cancelled

• all outstanding options to acquire Orko shares will be cancelled

• Orko shares of dissenters will be transferred to First Majestic for their fair value

• each outstanding Orko share will be transferred to First Majestic for an "indivisible mixture" of 0.1202 of a First Majestic share and $0.0001 in cash

• each Orko share will be transferred to Subco in consideration for one Subco share and, at the same time, the stated capital of the Orko shares will be reduced in aggregate to $1.00

• Orko and Subco then "shall merge to form one corporate entity ("Amalco") with the same legal effect as if they had amalgamated under Section 269 of the Business Corporations Act, except that the legal existence of Orko shall not cease and Orko shall survive the merger as Amalco…[and] the separate legal existence of Subco shall cease…and Orko and Subco shall continue as one company…."

These transactions would result in the number of issued and outstanding First Majestic shares increasing from 116.8M by up to 17.1M.

Canadian tax consequences

In the absence of an s. 85 election, the exchange will occur on a non-rollover basis. The deadline for providing an s. 85(1) election form to First Majestic is 90 days after the Effective Date of the plan of arrangement. Capital gains/loss treatment will apply to dissenters except re interest. Standard (non-informative) taxable Canadian property disclosure for non-residents.

U.S. tax consequences

Structuring of merger. The "Arrangement has been structured to qualify as a tax-deferred reorganization under the Code" (p.50). The U.S. tax "summary assumes that the Arrangement Transactions will be treated for U.S. federal income tax purposes as if Subco and Orko merged with Orko surviving the merger and Subco ceasing to exist as a separate legal entity" (p.60).

S. 368(a) reorg

The arrangement should qualify as a tax-deferred reorganization under Code s. 368(a) – so that if the PFIC rules do not apply, a U.S. holder should not recognize gain.

PFIC rules

Orko believes that it and its subsidiaries have been and are PFICs, and First Majestic believes that it is not currently a PFIC and will not be one for any subsequent year. On this basis, a shareholder who has not made a timely QEF election will be required to recognize gain (but not loss) as a result of the arrangement, regardless of whether it qualifies as a reorganization based on the fair market of the First Majestic shares (and nominal cash) received, with such gain being subject to tax and interest charges under the PFIC excess distribution regime. However, a U.S. Holder who has made a mark-to-market election may benefit from the treatment of the arrangement as a reorganization. A U.S. Holder who has made a timely QEF election also will be required to recognize gain if First Majestic was not a PFIC.