Effective Energy/Uranium One -- summary under Direct Target Acquisition

Overview

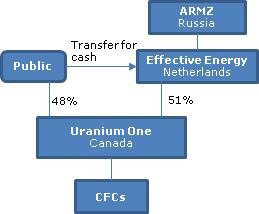

Under a CBCA plan of arrangement, shareholders of Uranium One, which is a TSX- and JSE-listed Canadian corporation, will receive Cdn.$2.86 cash per common share (or the Rand equivalent in the case of South African shareholders) from Effective Energy, representing a 32% premium over the 20 day pre-announcement VWAP on the TSX. ARMZ is the Russian parent of Effective Energy, a Netherland public limited liability company, and is an indirect wholly-owned subsidiary of Rosatom Nuclear Energy State Corporation. Effective Energy and another wholly-owned subsidiary of ARMZ together hold 51.4% of the shares of Uranium One. The cash consideration for the minority shares aggregates $1.3 billion.

Break fee

$45 million.

Plan of Arrangement

Under the Plan of Arrangement:

- Each common share of a dissenter will be transferred for its fair value to Effective Energy

- Each common share other than those of ARMZ or affiliates, or of dissenters, will be transferred to Effective Energy for cash of $2.86

- Each stock option will be cancelled in exchange for a cash payment equal to its in-the-money value (based on the $2.86 per share consideration) plus, in the case of an employee/officer optionholder, a payment on December 31, 2013 equal to the black-scholes value of the option minus the amount of any in-the-money payment received

MI 61-101 analysis

The arrangement is a business combination requiring a formal valuation of the Uranium One common shares. The arrangement resolution must be approved by a simple majority of the shareholders who are not interested parties. Interested parties hold 51.49% of the common shares and 50.21% of the stock options.

Canadian tax consequences

The acquisition will occur on a taxable basis. Standard taxable Canadian property disclosure.

U.S. tax consequences

Uranium One believes that it did not constitute a PFIC for its 2008 to 2012 taxation years, and expects that it should not be a PFIC for its 2013 year.