Burger King/Tim Hortons

Overview

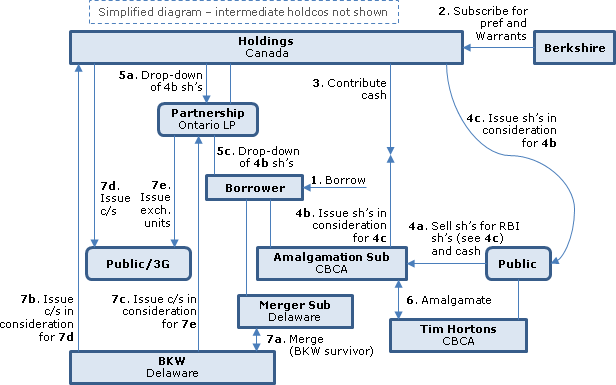

Burger King Worldwide and Tim Hortons will effectively combine so that they will be held indirectly by a TSX-listed Ontario partnership (Partnership) of which a TSX and NYSE listed CBCA holding company (Holdings - formerly a B.C. ULC) held by former Tim Hortons and Burger King Worldwide shareholders will be general partner and the remainder of Burger King Worldwide shareholders will be limited partners. In the first set of transactions (mostly under a CBCA arrangement), a Partnership indirect Canadian subsidiary (Amalgamation Sub) will acquire Tim Hortons, resulting in Tim Hortons becoming an indirect subsidiary of both Holdings and Partnership and with cash being paid to Tim Hortons shareholders who elect cash (based on their election and subject to an aggregate cap of U.S.$8B) - and with those U.S. shareholders receiving Holdings shares benefiting from Code s. 351 reorg treatment. In the second principal step (the merger), Merger Sub (an indirect Delaware sub of Partnership) will merge into Burger King Worldwide, with Burger King Worldwide as the survivor, so that Burger King Worldwide becomes an indirect subsidiary of both Holdings and Partnership. On this merger, Burger King Worldwide stockholders can elect to receive exchangeable LP units of Holdings (so as to access Code s. 721 rollover treatment) rather than mostly shares of Holdings. In a preliminary step, Berkshire Hathaway Inc. ("Berkshire") will provide $3B of voting preferred share financing of Holdings together with an equity kicker (the warrant). Based on Holdings holding more than 50% in vote and value of Partnership interests and ex-Burger King Worldwide shareholders owning less than 80% of the Holdings and Partnership equity, as well as on substantial post-merger Canadian business activity, the Code s. 7874 rule should not deem Holdings or Partnership to be a U.S. corporation.

See full summary under Other - Continuances/Migrations - Inversions.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Public Transactions - Other - Continuances/Migrations - Inversions | Merger of Tim Hortons and Burger King Worldwide in inversion transaction | 2591 |

Kingspan/Vicwest/Westeel

Overview

In order to accomplish (under an OBCA Plan of Arrangement) a sale of a storage business (the Westeel Business) of Vicwest to the Westeel Purchaser and the effective use of those proceeds to fund an acquisition by a resident subsidiary (the BP Purchaser) of Kingspan Group Limited (BP Purchaser Parent) of all the shares of Vicwest, Vicwest will drop the Westeel Business into a Newco subsidiary (Westeel Canada) and the BP Purchaser will use the proceeds of a loan from the Westeel Purchaser to acquire all the Vicwest shares, bump the Westeel Canada shares under s. 88(1)(d) on a vertical amalgamation and (qua Amalco) transfer all the Westeel Canada shares (along with the shares of some non-resident subsidiaries) to the Westeel Purchaser in repayment of the loan.

Vicwest

Vicwest is a TSX-listed OBCA corporation and one of Canada's leading manufacturers and distributors of building construction products and steel containment products for agricultural grain, fertilizer and liquid storage. As at the close of business on December 22, 2014, there were issued and outstanding 17,648,142 Vicwest common shares, 520,000 Vicwest options, 236,112 Vicwest deferred share units ("DSUs"), 156,151 Vicwest performance share units ("PSUs") and $82,000,000 principal amount of Vicwest Debentures (in two series trading on the TSX).

Significant Vicwest Shareholder

Saul Koschitzky and IKO Enterprises Ltd. (collectively, the Significant Shareholder") hold 11.23% of Vicwest's common shares.

BP Purchaser/Parent

The BP Purchaser is a wholly-owned, indirect OBCA subsidiary of the BP Purchaser Parent created for the sole purpose of the acquisition of the Vicwest shares. The BP Purchaser Parent is a UK corporation. Kingspan Group plc, the indirect parent company of the BP Purchaser Parent, is a global leader in high performance insulation, building fabric and solar integrated building envelopes.

Westeel Purchaser/Parent

The Westeel Purchaser Parent is a CBCA corporation and a leading manufacturer of portable and stationary grain handling, storage and conditions equipment. The Westeel Purchaser is a wholly-owned CBCA subsidiary of the Westeel Purchaser Parent.

Asset Transfer Agreement

For the sale of assets of the "Westeel Business" of Vicwest (re seed, fertilizer and water storage) to 2441050 Ontario Limited ("Westeel Canada") in consideration for the assumption of liabilities and the issuance of common shares of Westeel Canada. This asset transfer essentially will occur effective the beginning of the Plan of Arrangement. A s. 85(1) election will be filed for the transfer to occur on a rollover basis.

Plan of Arrangement

- the Shareholder Rights Plan of Vicwest will be cancelled;

- the transactions contemplated by the Asset Transfer Agreement to be completed at the Effective Time of the Plan of Arrangement will be completed and become effective;

- the Westeel Purchaser will make the "Westeel Loan" of $221.5M to the BP Purchaser;

- the BP Purchaser will make the "Change of Control Settlement Loan" to Vicwest in an amount sufficient to repay the "ABL Facility" owing by Vicwest to CIBC and National Bank and to fund the payments in 5 below;

- all Vicwest PSUs, DSUs and options will be cash surrendered;

- each Vicwest common share other than any "Dissent Shares" for which rights of dissent have been validly exercised will be transferred to the BP Purchaser in exchange for cash of $12.70 per share, and each Dissent Share will be transferred to the BP Purchaser in consideration for a debt claim against the BP Purchase;

- Vicwest will repay the ABL Facility;

- the Change of Control Settlement Loan will be deemed to have been settled by a contribution of capital by the BP Purchaser to Vicwest;

- Vicwest will file with the CRA an election to cease to be a "public corporation";

- the stated capital of the Vicwest Shares will be reduced to $1.00;

- Vicwest and the BP Purchaser will be amalgamated to form Amalco under s. 177(1) of the OBCA, with the share capital of Amalco the same as the BP Purchaser; and

- in satisfaction of the Westeel Loan, all the shares of Westeel Canada and of certain non-resident subsidiaries will be transferred by Amalco to the Westeel Purchaser.

Vicwest Debentures

Vicwest currently intends to deliver a conditional notice of redemption of the first series of debentures conditional on completion of the Arrangement and, in the case of the second series, to hold a meeting of the holders to approve amendments permitting their redemption at a premium after the closing of the Arrangement.

Voting Agreement/s. 88(1)(c.3) property

The Significant Shareholder agreed, for a period of one year following the Effective Date of the Plan of Arrangement, that the Significant Shareholder will not purchase or otherwise acquire, directly or indirectly:

- convertible debentures issued by Vicwest or Westeel Purchaser Parent;

- common shares of Kingspan Group plc or of Westeel Purchaser Parent;

- "any other property that has previously been specifically identified to them by the BP Purchaser or the Westeel Purchaser, more than 10% of the fair market value of which is wholly or partly attributable to any property that was owned by [Vicwest] immediately prior to the Effective Time;

- any other property that has previously been specifically identified to them by the BP Purchaser or the Westeel Purchaser, the fair market value of which is determinable primarily by reference to the fair market value of, or to any proceeds of disposition of, any property that was owned by the Company immediately prior to the Effective Time; or

- any other securities convertible or exchangeable into any such securities or property apart from any such securities or other property that they may acquire, directly or indirectly, by reason of such securities or other property being held or acquired by an investment or pooled fund vehicle in which they have or acquire an interest and over which they do not have any influence."

Canadian tax consequences

"The disposition of Vicwest Shares by a Holder to the BP Purchaser will result in a capital gain (or capital loss) to the Holder… ."