Starlight-KingSett/Northview

Overview

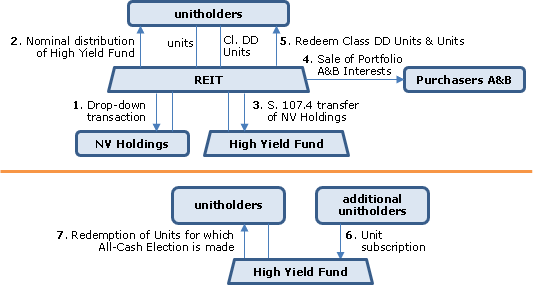

It is proposed that the unitholders of the REIT will receive mostly cash from Starlight and KingSett funds for their REIT units. However, the purchasing funds will not end up with all the assets of the REIT. The two purchasers will acquire a portion of the assets after they have been suitably packaged into partnerships, with the REIT intending to push out the resulting capital gains (presumably with an eye on avoiding issues under s. 132(5.3)) using the capital gains refund mechanism.

Furthermore, some of the real estate will have first been packaged into a “High Yield Fund,” that is intended to qualify as a REIT and that effectively will be distributed to those unitholders who are interested in receiving units of that fund in lieu of full cash proceeds for their units. This will be accomplished by the REIT settling the new unit trust (the High Yield Fund) with $1,000 in cash, distributing $1,000 of cash to the REIT unitholders, selling its units of the High Yield Fund to the REIT unitholders for $1,000 in cash, and then effecting a s. 107.4 transfer of a holding LP for the real estate in question from it to the High Yield Fund. Those unitholders who have elected to receive only cash then will have their High Yield Fund units redeemed for $7.06875 per unit, in addition to having their REIT units redeemed for $29.18125 per unit. Those who want to retain the High Yield Fund units will not have those units redeemed, so that they only receive cash for their REIT units – and in effect receive their High Yield Fund units on a tax-deferred basis.

The High Yield Fund will need cash to accomplish the above. It is expected to complete the Offering, of up to $430,000,000 of units concurrently with the completion of the (Alberta) Arrangement.

Full Pt. XIII.2 tax will be withheld from the redemption proceeds paid to non-resident unitholders.

The REIT

The REIT is an Alberta trust that became a public real estate investment trust in May 2002, holding multi-residential and commercial rental real estate through subsidiary LPs, some of which have exchangeable LP units. At the time of the Initial Offer, Mr. Drimmer owned, directly and indirectly (principally through Starlight), 2,344,396 REIT Units, 1,736,306 class B limited partnership units of Subsidiaries of the REIT and 12,388,267 redeemable limited partnership units of Subsidiaries of the REIT. Mr. Drimmer has also been a trustee of the REIT.

KingSett

KingSett Real Estate Growth LP No. 7 and KingSett Canadian Real Estate Income Fund.

Purchasers

Purchaser A and Purchaser B, being Galaxy Real Estate Core Fund LP and Galaxy Value Add Fund LP, respectively.

High Yield Fund

Northview Canadian High Yield Residential Fund, a new multi-residential fund that will acquire a geographically diverse portfolio of the REIT’s properties under the Plan of Arrangement and the sole unitholder of which as of the Effective Time will be the REIT. The High Yield Fund is expected to complete the Offering, of up to $430,000,000 of Listed High Yield Fund Units (being Class A Units listed on an exchange) and Class F High Yield Fund Units, concurrently with the completion of the Arrangement. The High Yield Fund will target an annual pre-tax distribution yield of 10.5% across all unit classes on gross subscription proceeds received by the High Yield Fund. The High Yield Fund will be externally managed by a wholly-owned subsidiary of Starlight.

High Yield Fund Partnerships

REIT Subsidiaries designated as “High Yield Fund Partnerships” in the Pre-Closing Notice

Pre-Closing Notice

A notice to be delivered by the Purchasers to the REIT three business days prior to the Effective Date specifying certain amounts and other actions required to be taken in furtherance of the Arrangement.

REIT Redemption Price

$29.18125, assuming no special distribution.

DD Unitholders

Unitholders, holding the DD Units, affiliated with D.D. Acquisitions Partnership as specified in the Pre-Closing Notice

High Yield Fund Subscription Election

Unitholders will have the option of investing alongside Starlight and KingSett by electing to receive 0.5655 High Yield Fund Units on a tax deferred basis and the remaining $29.18 of the Consideration of $36.25 per REIT Unit on a taxable basis in cash, High Yield Fund Units or a combination of cash and High Yield Fund Units (other than Unitholders resident in or otherwise located in the United States, who will receive cash), subject to proration. In particular, each Unitholder will be entitled to receive, for each REIT Unit held (or in the case of a holder of an Exchangeable LP Unit, for each REIT Unit into which such Exchangeable LP Unit is exchangeable on the Effective Date), at such Unitholder’s election, either (i) $36.25 in cash pursuant to the All-Cash Election on a taxable basis, or (ii) 0.5655 High Yield Fund Units on a tax deferred basis and the remainder of the Consideration of $29.18 on a taxable basis in cash, High Yield Fund Units or a combination of cash and High Yield Fund Units elected by the Unitholder (other than Unitholders resident in or otherwise located in the United States, that will receive cash), subject to proration, pursuant to the High Yield Fund Subscription Election.

Plan of Arrangement

- The current Trustees will resign and simultaneously Trusteeco (a corporation specified prior to closing) will become the sole Trustee of the REIT.

- Each Dissenting Unit will be transferred to the REIT for a debt claim against the REIT.

- Each Exchangeable LP Unit will be redeemed by the issuance of REIT Units.

- The Unitholder Rights Plan will be terminated.

- Each participant under the Deferred Unit Plan, and each holder of a Performance Award or Restricted Award, will surrender their rights in exchange for a cash payment.

- The REIT will pay out in cash any special distribution required to reduce its taxable income.

- The REIT will subscribe $1,000 for a number of additional High Yield Fund Units, so as to result in the same number thereof as its issued and outstanding REIT Units.

- The REIT will pay out, as a special distribution on the REIT Units, a cash distribution of $1,000.

- The REIT will transfer to each holder of REIT Units, on a pro rata basis in proportion to their respective holdings of REIT Units, all of the High Yield Fund Units held by the REIT for an aggregate purchase price of $1,000, such that each Unitholder will hold one High Yield Fund Unit for each REIT Unit held.

- In accordance with ITA s. 107.4, the REIT will transfer all of its limited partnership interests in the High Yield Fund Partnerships and the shares or units of the general partners thereof to the High Yield Fund for no consideration by way of a “qualifying disposition” (as defined in s. 107.4(1).)

- At 2:01 a.m. on the day immediately following the Effective Date, refinancing distribution steps will be completed in the order and in the manner specified in the Pre-Closing Notice.

- Pursuant to and in accordance with the Portfolio A (and B) Purchase Agreement, Purchaser A (and Purchaser B) will purchase all of the Portfolio A (and B) Interests (as designated in the Pre-Closing Notice) from the Portfolio A (and B) Sellers for an aggregate purchase price equal to the Portfolio A (and B) Purchase Price specified in the Pre-Closing Notice, satisfied in cash and for the Portfolio A (and B) Purchase Notes.

- Benco (being a corporation specified in the Pre-Closing Notice) will subscribe for one REIT Unit for a subscription price equal to the REIT Redemption Price (of $29.18125, assuming no special distribution).

- The proceeds of the sale of the Portfolio A Interests or Portfolio B Interests will be distributed up the chain to the REIT.

- The REIT will redeem the DD Units for a redemption price per REIT Unit equal to the REIT Redemption Price and will satisfy the redemption price by transferring to the DD Unitholders, the Portfolio A Purchase Notes, the Portfolio B Purchase Notes and an amount of cash equal to the remainder of the redemption price payable.

- The REIT will redeem all of the issued and outstanding REIT Units not redeemed in the step above (other than the one REIT Unit held by Benco) for a cash redemption price per REIT Unit equal to the REIT Redemption Price. Following this redemption, Benco will be the sole unitholder of the REIT.

- The Additional High Yield Fund Subscribers will subscribe for units of the High Yield Fund for the aggregate subscription price and in the manner specified in the Pre-Closing Notice and in accordance with their election for a subscription price of $7.06875 per unit.

- Each High Yield Fund Unit purchased pursuant to 9 with the proceeds from the $1,000 "Nominal Cash Distribution" held by those who have made the All-Cash Election will be redeemed by the High Yield Fund for a cash redemption price equal to the High Yield Fund Redemption Price (of $7.06875).

- The High Yield Fund Units (including any Additional High Yield Fund Units issued in 17 above) shall be consolidated based on the Consolidation Ratio (of 1:1.7683) (the “Consolidation”)

Canadian tax consequences

Pre-Acquisition Reorganization

In the transaction steps to be proposed by the Purchasers for the direct or indirect transfer of Properties, which may include their transfer to separate limited partnerships and the dissolution of REIT Subsidiaries (the “Pre-Acquisition Reorganization”), the REIT will realize capital gains (or losses) and may also realize recapture of depreciation. However, s. 97(2) elections will be filed consistently with the mutual intention of the REIT and Purchasers that the Pre-Acquisition Reorganization together with any transactions undertaken after the Effective Date which may have tax consequences for the Stub Year (ending on the Arrangement date shall not result in the REIT realizing any ordinary income (including recapture) if such amounts would increase the REIT’s taxable income (other than taxable capital gains) that is distributed to Unitholders in 2020 as a monthly distribution or Stub Distribution by more than 20% of the aggregate amount of such distributions.

Transfers of Portfolio A and B

The REIT intends to offset (or receive a refund in respect of) its liability for tax on any net realized taxable capital gains arising from the transfer of the Portfolio A Interests and Portfolio B Interests pursuant to ITA s. 132.

S. 107.4 disposition of NV Holdings LP

The REIT’s disposition of its limited partnership interests in the High Yield Fund Partnerships and shares or units of the general partners is intended to be a s. 107.4 “qualifying disposition,” so that the REIT will be deemed to dispose of such shares or units for their adjusted cost base.

Stub Year and stub partnership income

The current taxation year of the REIT will be deemed to end at the end of the Effective Date (the “Stub Year”) and the REIT will not elect for such deeming provision to not apply. The REIT has agreed to seek approval of the CRA to change the fiscal periods of the Subsidiary Partnerships in order to ensure, to the extent possible, that substantially all of the income and net taxable capital gains earned by each Subsidiary Partnership on or before the Effective Date will be allocated to the REIT in the Stub Year.

Acquisition of High Yield Fund Units and Transfer of Properties by the REIT to the High Yield Fund

Each Resident Holder will acquire one High Yield Fund Unit from the REIT for each REIT Unit held at a nominal cost. A Resident Holder will not realize any taxable income or gain solely as a result of the Qualifying Disposition. Immediately after the Qualifying Disposition, the adjusted cost base of a Resident Holder’s REIT Units will be decreased by an amount corresponding to the proportionate reduction in the fair market value of a REIT Unit, and the adjusted cost base of a Resident Holder’s High Yield Fund Units will be increased by the same amount.

Redemption of REIT Units

All REIT Units, other than those held by Dissenting Unitholders and Benco, will be redeemed in cash for the REIT Redemption Price, thereby generally resulting in a capital gain (or a capital loss) to the Resident Holder.

All-Cash Election

A Resident Holder making the All-Cash Election for the Resident Holder’s High Yield Fund Units to be redeemed for a cash redemption price equal to the High Yield Fund Redemption Price (of $7.06875), will thereby realize a capital gain based on the excess over the nominal ACB of such units.

High Yield Fund Subscription Election

A Resident Holder who validly makes a High Yield Fund Subscription Election to retain the Resident Holder’s High Yield Fund Units acquired from the REIT and, if applicable, subscribe for additional High Yield Fund Units will retain the High Yield Fund Units acquired from the REIT, and generally acquire each additional High Yield Fund Unit at a cost equal to the amount that the Resident Holder pays to acquire it, being the High Yield Fund Subscription Price (of $7.06875).

Consolidation

A Resident Holder will not realize any taxable income or gain solely as a result of the Consolidation.

High Yield Fund as REIT

It is assumed that the High Yield Fund will qualify for the REIT Exception from the SIFT rules. The High Yield Fund will acquire its interest in in its holding partnership (NV Holdings LP) in a transaction intended to qualify as a “qualifying disposition,” so that it will have an ACB for that interest less than its FMV.

Non-resident holders and Pt. XIII.2 tax

The REIT will treat each REIT Unit as a “Canadian property mutual fund investment” and withhold Pt. XIII.2 tax of 15% from the redemption proceeds of the REIT Units and (where the All-Cash Election was made) High Yield Fund Units of non-residents. The REIT will withhold on account of the Mutual Fund Withholding Tax on the entire amount paid to a Non-Resident Holder in connection with the redemption. A Non-Resident Holder may be able to obtain a refund of such tax to the extent that (i) the Non-Resident Holder has “Canadian property mutual fund losses”, which generally would include any losses realized by the Non-Resident Holder on the disposition of its REIT Unit on the redemption thereof or (ii) (in the case of REIT Units) they are determined not to be Canadian property mutual fund investments.

It is proposed that the unitholders of the REIT will receive mostly cash from Starlight and KingSett funds for their REIT units. However, the purchasing funds will not end up with all the assets of the REIT. The two purchasers will acquire a portion of the assets after they have been suitably packaged into partnerships, with the REIT intending to push out the resulting capital gains (presumably with an eye on avoiding issues under s. 132(5.3)) using the capital gains refund mechanism.

Furthermore, some of the real estate will have first been packaged into a “High Yield Fund,” that is intended to qualify as a REIT and that effectively will be distributed to those unitholders who are interested in receiving units of that fund in lieu of full cash proceeds for their units. This will be accomplished by the REIT settling the new unit trust (the High Yield Fund) with $1,000 in cash, distributing $1,000 of cash to the REIT unitholders, selling its units of the High Yield Fund to the REIT unitholders for $1,000 in cash, and then effecting a s. 107.4 transfer of a holding LP for the real estate in question from it to the High Yield Fund. Those unitholders who have elected to receive only cash then will have their High Yield Fund units redeemed for $7.06875 per unit, in addition to having their REIT units redeemed for $29.18125 per unit. Those who want to retain the High Yield Fund units will not have those units redeemed, so that they only receive cash for their REIT units – and in effect receive their High Yield Fund units on a tax-deferred basis.

The High Yield Fund will need cash to accomplish the above. It is expected to complete the Offering, of up to $430,000,000 of units concurrently with the completion of the (Alberta) Arrangement.

Full Pt. XIII.2 tax will be withheld from the redemption proceeds paid to non-resident unitholders.

See full summary under Mergers & Acquisitions - REIT/Income Fund/LP Acquisitions - LP Acquisitions of Trusts.