Inovalis

Overview

The REIT, which is an Ontario unit trust, is offering 10.5M units for $105M. It will acquire four leasehold interests in French and German office properties, which are currently managed by a privately owned investment management company with a Parisian head office ("Inovalis"). The aggregate acquisition cost of these leaseholds plus aggregate option exercise prices to acquire the related properties will be less than the properties' appraised value of €165 million (including €144 million for the French properties).

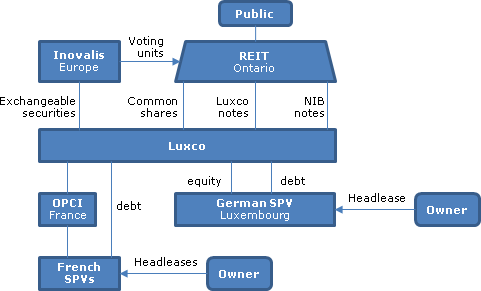

Structure

A Luxembourg subsidiary s.à r.l. of the REIT ("Luxco") will hold equity, and interest-bearing debt, of a wholly-owned German SPV of Luxco (also a s.à r.l.), which will hold the Hanover, Germany property. Luxco will hold interest-bearing notes of French SPVs holding the three Parisian properties and will hold the equity of the French SPVs through a French holding company ("OPCI"). Luxco will be capitalized with $5 million of non-interest bearing notes ("NIB Notes"), $5 million of 15-year notes bearing interest at 7.8% ("Luxco Notes") and common shares. Inovalis will hold exchangeable securities of Luxco (comprising NIB Notes, Luxco Notes and common shares) representing the equivalent of an approximate 10% ownership interest in the REIT, and will hold the equivalent number of special voting units of the REIT.

Redemption notes

The maturity date and interest rate on redemption notes issued by the REIT on any large unit redemptions will have a maturity date and interest rate to be determined by the Trustees at the time of issuance – or, alternatively, securities of REIT subsidiaries may be delivered in the Trustees' discretion.

Distributions

91% of distributions for 2013 (at an estimated monthly rate, following the initial distribution for most of the balance of 2013 of $0.6875 per unit) are estimated to be tax-deferred. Such distributions are estimated to approximate 93% of AFFO. Under an FX hedging arrangement, an arm's length counterparty will agree to exchange euros for Canadian dollars on a monthly basis at an agreed exchange rate. The DRIP will use 3% bonus distributions.

Management

The annual asset management fee of Inovalis, and 50% of its acquisition fees, will be paid entirely in exchangeable securities of Luxco. Upon the earlier of the REIT achieving a market capitalization of $750 million and the 5th anniversary, management will be internalized.

Canadian tax consequences

SIFT tax. The REIT will not be subject to SIFT tax on the basis of not holding any non-portfolio property. As it will not hold any taxable Canadian property, it is not subject to non-resident ownership restrictions.

FAPI

It is expected that the income of the REIT's subsidiaries will be foreign accrual property income. However, it is expected that the REIT's distributions will be sufficient for it not to be subject to Part I tax.

French tax consequences

Provided OPCI and the French SPVs comply with their distribution obligations (to inter alia distribute 85% of their distributable income), they are exempt from French corporate income tax. A French withholding tax of 5% will be levied on dividends paid by OPCI to Luxco (p. 61). There will be no withholding tax on the interest paid by the French SPVs to Luxco. As financial lease agreements are not considered to be real estate assets and no elections have been made to purchase real estate assets, the 3% tax assessed on directly or indirectly held real estate will not be applicable.

German tax consequences

Corporate income tax. The German SPV is a Luxembourg s.à r.l. that is managed in Luxembourg and, therefore, should not be resident in Germany for German tax purposes. However, it nonetheless will be subject to German corporate income tax rate at a rate of 15.825%. The German SPV is acquiring real estate under a head lease by prepaying the rent under the head lease, and earning rents from the sublessees. The rental payments received by it from the sublessees will be included in computing its income for German corporate income tax purposes; however, it will be able to take deductions based on amortization of the headlease prepayment. Deductions of interest should not be limited under the German interest barrier provided that the net interest expense of the German SPV is below €3 million p.a., and the financing arrangements comply with the arm's length principle.

Wthholding/trade tax

Dividends paid by the German SPV to Luxco should be exempt under the participation exemption. The German SPV should not be subject to municipal trade tax given that the mere subleasing of the property would not create a German permanent establishment.

RETT

The assumption of the headlease and the subleases, and the acquisition of the property option should not trigger German real estate transfer tax. However, RETT will be triggered (currently at a 4.5% rate) when the option is exercised.

Distributions

91% of distributions for 2013 (at an estimated monthly rate, following the initial distribution for most of the balance of 2013 of $0.6875 per unit) are estimated to be tax-deferred. Such distributions are estimated to approximate 93% of AFFO. Under an FX hedging arrangement, an arm's length counterparty will agree to exchange euros for Canadian dollars on a monthly basis at an agreed exchange rate. The DRIP will use 3% bonus distributions.

Full summary under Offerings - Cross-Border REITs.